Revenue Growth Management and the Critical Data Behind Its Success

Revenue Growth Management (RGM) is one of the highest growth organizations within the consumer products industry. To effectively manage and execute a winning revenue growth model, consumer packaged goods (CPG) companies must know what data is actually required and where to obtain it.

Revenue Growth Management is one of the oldest business functions in the consumer products industry for manufacturers and suppliers. While the past typically saw this organization as specializing in pricing and price management, the market forces have driven CPG companies to broaden the scope of the RGM function and, in the process, elevated its leadership to as high as a C-suite role, in many companies.

Now, we see the RGM organization responsible for not only price management but product assortment management, trade and channel promotion management, and retail execution. It makes sense because during the typical annual integrated business planning (IBP) process, most of these post-production business drivers are intended to define and deliver the forecasted revenues.

In fact, according to the Promotion Optimization Institute’s (POI) 2024 State of the Industry report, the top two business activities owned by RGM organizations are Pricing Ownership (93%) and Trade Promotion Analytics and Optimization (89%). The HPM 2023 Survey on Trade Promotion aligns, showing that of all the trade spending done globally in 2023, 69% is to support a temporary price reduction—the highest category of trade promotion tactics measured.

The POI report also shows that to gain higher efficiency and effectiveness, two of the most commonly stated areas of improvement are Defining Growth Drivers (83%) and Data Ownership, Cleansing & Harmonization (60%).

This means that the responsibility for making sure the data is accurate, trustworthy, and timely is quickly becoming a major RGM mission. Smart companies are recognizing this and concentrating the daily management of these drivers into the RGM unit ownership.

The other important aspect of this is the reorganization of the data that is required to generate the analysis of business performance—i.e., consolidating all that data into a single management base instead of multiple siloes of data throughout the value chain organization.

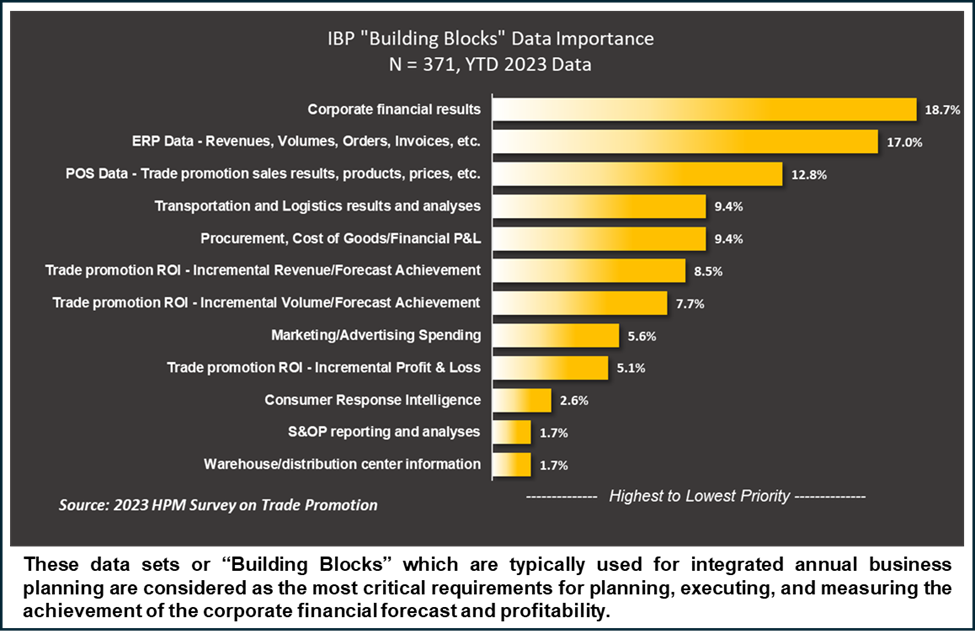

Nowhere is this more critical than in annual corporate planning, commonly referred to as the Annual Integrated Business Planning process. Attempting to consolidate and coordinate all these critical data drivers or “building blocks” of revenue generation is one of the most difficult issues any consumer products company faces.

the Most Common Data Requirements for IBP

The duration of a typical IBP process can range from 2 to 6 months and may extend further in some cases. One of the most common reasons for this is the time it takes to find, assess, consolidate, and corroborate the data coming from so many locations and sources. Multiple siloes of data typically exist throughout internal organizations such as the supply chain, finance, trade promotion, retail execution, and marketing, as well as via external sources like syndicated data providers, ad agencies, and consumer research reporting suppliers.

The RGM organization is rapidly becoming the most popular home for all data required for determining, managing, and measuring the overall corporate revenue growth drivers.

In the chart above, notice that the top three data sets include corporate financials, ERP data, and point of sale (POS) data—the latter being designated higher in last year’s HPM 2023 Survey on Trade Promotion than at any time before. It denotes that the importance of retail sales as a direct result of a promotion are not only a high priority, but the timing of that data is also critical. The sooner POS data is received and processed, the faster both the consumer products company and the retailer can react.

If you consider the first two data sets as a standard for every consumer products company, then notice that POS data is now considered the most critical set of drivers that the company needs to successfully achieve targeted forecasts and profitability. The struggle to coordinate all these “building blocks” into a cohesive and aligned annual plan is one of the most dreaded operational functions in the consumer products industry today, but it is also the driving force for making sure the data is unquestionably accurate.

Key Issues with Data

The HPM 2023 Survey on Trade Promotion also shows the top three issues with this data are Accuracy of Data, Lack of Granularity, and Latency of Data. While the syndicated data providers provide important analyses of instore and consumer sales response to promotions, the need to have more data accuracy and coverage across the retail landscape is suffering from the practices of sampling methodologies currently used for store locations and markets. Especially for brick-and-mortar retail consumer measurements, the reduced sample sizes of markets and number of locations actually tracked impede the ability to catch critical instore promotional activity and can often lead to erroneous assumptions of promotional performance.

The lack of data granularity, especially in areas of measurement of inventory availability on-shelf and at the distribution centers, continues to haunt the key account managers’ ability to avoid damaging out-of-stock conditions that are still so prevalent across the consumer goods industry. The cost for capturing more details from existing syndicated providers often prohibits the ability to do a thorough analysis of promotional performance.

The technology and talent required to do more effective measurement and analysis of promotional performance also dramatically impacts the ability to optimize promotional spending and build more advanced analytical tools to support a higher level of data granularity.

According to the POI 2023 State of the Industry report, Budget/Cost ranks as the top reason for the inability to evolve the platforms for optimizing trade promotion spending, with 45% of the survey audience reporting. Tied for the second highest reason is Proper Data Cleansing and Harmonization at 36%.

"POS data is rapidly becoming the most sought-after intelligence, especially when it is available within 24 to 48 hours of the purchase and covers every single store in the retailers’ marketplaces."

Everyone agrees that in today’s modern consumer products industry, the sooner the intelligence, the more rapid the response, thus, the need for sophisticated retail data collection, cleansing, and harmonization solutions such as Retail Velocity’s VELOCITY® platform. Consumer products companies have struggled forever with the question of data latency and given the rapid rise of online e-commerce as a preferred location for shopping, it means that waiting for weeks to understand the effect of promotion on retail store sales is no longer tolerable.

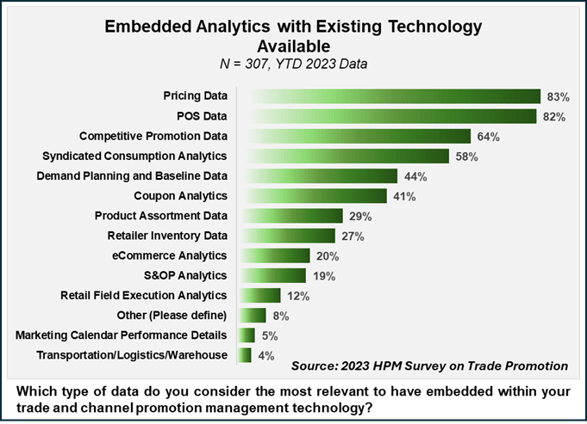

Considering the need to have data quickly available to all sales, marketing, store, and distribution personnel charged with the responsibility for achieving forecast performance, note that POS data is the second most demanded data.  Further, we noted in the survey that this also meant direct point of sale data from the retailer and if at all possible, the day after reporting. This would enable more effective and efficient measurement of overall corporate financial performance as well.

Further, we noted in the survey that this also meant direct point of sale data from the retailer and if at all possible, the day after reporting. This would enable more effective and efficient measurement of overall corporate financial performance as well.

The total need for accurate, timely, and trustworthy retail data is being challenged across the entire landscape of consumer products. POS data is rapidly becoming the most sought-after intelligence, especially when it is available within 24 to 48 hours of the purchase and covers every single store in the retailers’ marketplaces. Only then can the brick-and-mortar retail sales performance be analyzed more accurately and effectively aligned to online e-commerce sales analytics to provide a holistic understanding and evaluation of consumer engagement.

Conclusion

The RGM organization is poised to become the primary pillar of ownership of consumer sales performance and analysis across the greater consumer products industry, and well they should be. Having the right data, the means to efficiently collect that data through solutions like VELOCITY®, and knowing what to measure is quickly becoming the most important focus of the C-suite for both the supplier and the channel.

About the Author

Rob Hand is the founder and CEO of Hand Promotion Management, a consulting company providing domain expertise across more than 25 consumer-facing industries. Focused on consumer products and retail, he has a 45-year history of helping consumer goods manufacturers improve their trade promotion spending ROI, performance analytics, retail execution, consumer engagement efficiency, and marketing effectiveness.

Rob Hand is the founder and CEO of Hand Promotion Management, a consulting company providing domain expertise across more than 25 consumer-facing industries. Focused on consumer products and retail, he has a 45-year history of helping consumer goods manufacturers improve their trade promotion spending ROI, performance analytics, retail execution, consumer engagement efficiency, and marketing effectiveness.

Rob is a frequent podcaster, blogger, and speaker on the topics of revenue growth management and business process innovation. He is the author of the recently published and popular book “The Invisible Economy of Consumer Engagement,” which outlines how consumer products goods companies can achieve the highest value in both promotion ROI and consumer engagement.